Quarterly Market Review: Q4 2022

By: Paul Dickson, Director of Research and Mark Stevens, Chief Investment Officer

The New Map

The post crisis economic and investment era is moving to the rear-view mirror as new drivers emerge.

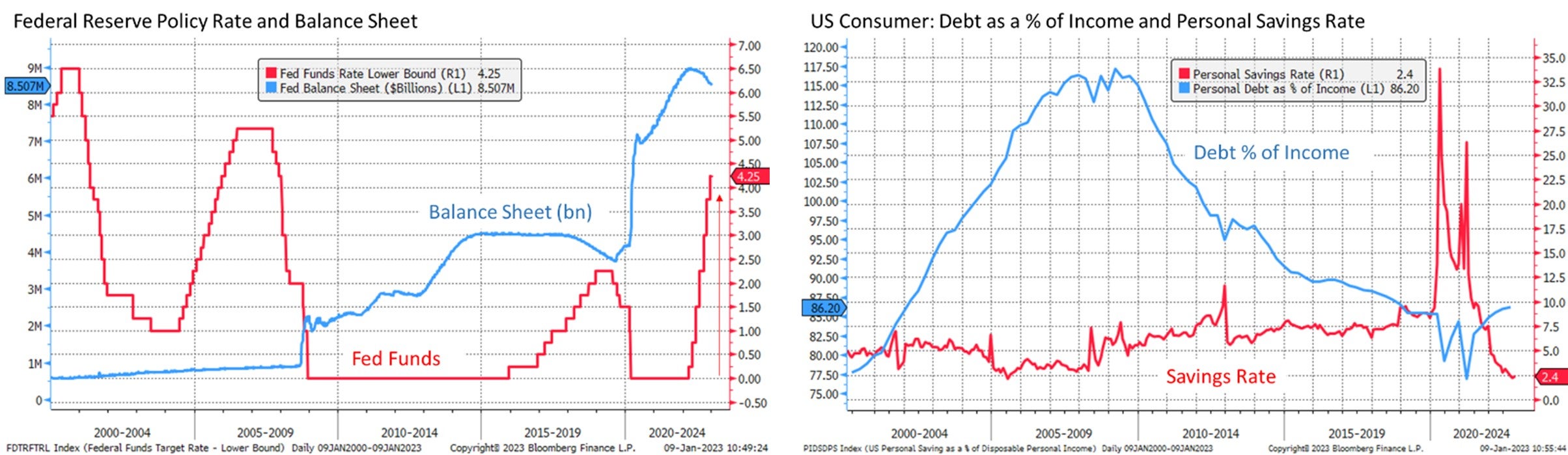

One year ago, we published our market review for the fourth quarter of 2021 and presented an outlook for 2022 that we termed “Shifting Gears.” Those shifts included our expectations for a significant tightening in monetary policy via interest rate increases and a decline in the Federal Reserve’s (Fed) balance sheet. That balance sheet of almost $9 trillion of U.S. government securities is the legacy of the Fed’s repeated efforts to rescue the economy from first the Global Financial Crisis and a recession and, most recently, the pandemic-stricken economy. We also pointed to the largest decline in the U.S. government deficit in terms of Gross Domestic Product (GDP) since World War II. Those two developments were the downshifts that threatened the economic and market outlook. Countering those were the economy’s emergence from the pandemic and the significant savings consumers had amassed during the period. These savings represented repressed spending and the tremendous support provided by the government to cushion the economy from the Covid-19 crisis. Spending down those savings was expected to allow the economy to transition from one reliant on government and central bank support to a more consumer driven one.

Each of these anticipated shifts took place during a year when interest rates rose significantly as the Fed hiked policy rates at an unprecedented pace. While the government announced new spending priorities, these will transpire over many years and in the end the fiscal deficit did decline a record setting amount. Consumer demand held firm and exceeded expectations, allowing the economy to avoid recession in 2022 as excess savings from the pandemic were spent. Support for the economy shifted from the official sector to that of the consumer largely as designed. The third quarter saw a growth rate estimated at better than 3% year over year and estimates by the Atlanta Federal Reserve Bank paint a reasonably strong fourth quarter.

That final quarter of 2022 was a transition from one road map to a new one. Since the Global Financial Crisis, the economy has been dogged by the risk of deflation and extraordinary monetary efforts to counter that. By mistake, the Fed “broke the back of deflation” in a mirror image of the way the Volcker Fed of the early 1980s broke that of inflation. Volker’s unprecedented tight monetary policy ended inflation then just as unprecedentedly loose pandemic-era policy ignited the inflation of the past year.

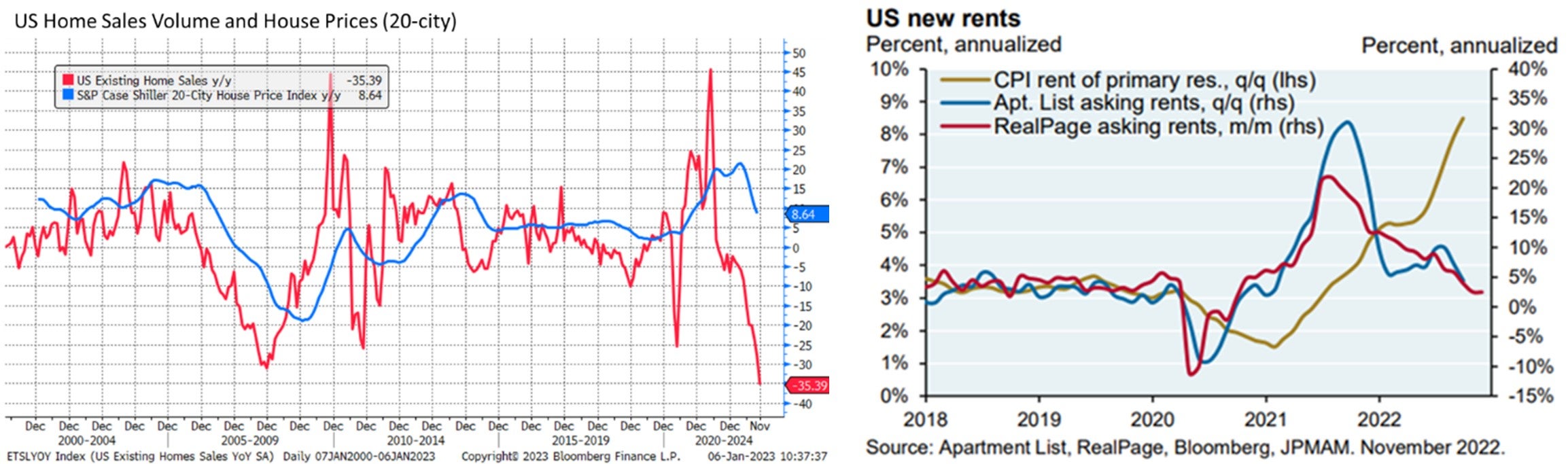

![]()

Now the economy is transitioning to a new phase. The Fed has completed well over half of its expected rate hikes and started slowing the pace of those increases. They indicated that the tightening process should be completed in the first half (if not the first quarter) of 2023. This fits with contemporaneous economic data showing a softening of inflation and signs that the most pressing underlying causes are abating, including easing supply constraints and energy prices. The Institute of Supply Management (ISM) Purchasing Managers Surveys for Manufacturing and Service Sectors have fallen into contraction territory, signaling an economic slowdown. Higher mortgage rates have translated into a sharp decline in housing activity and prices, which should slow the almost one third weighting of the inflation indices linked to shelter expenses. Those prices tend to fall with a lag as rents are negotiated on a forward annual basis. While they might not be reflected in the Consumer Price Index (CPI) quickly, other data available shows that they will be over time.

One significant economic outlier has been the resilience of the labor market. The unemployment rate has again fallen to a 50-year low, and job openings remain nearly twice that of people looking for work. The tightness of the labor market remains a risk to the outlook, even as wage growth and job openings have started to moderate. Fed officials have continuously reminded everyone that a wage-price spiral is a more dangerous outcome than a recession.

Fighting the Fed is Fashionable if (maybe) Foolish

How Fed policy evolves over the coming year is of central importance to the markets and the economy. The Fed believes it will have to hike rates at least two more times and maintain that level through the year. The markets, especially the bond market, do not believe in the Fed’s outlook. Instead, they see recession risks rising in 2023 and the Fed cutting rates before the end of the year. For this reason, the U.S. Treasury yield curve has been inverted for many months now, with the 2-year yield significantly higher than the 10-year yield. An inverted yield curve is the classic sign that bond market pricing is in a recession, which the market assumes would lead to a reversal of Fed policy.

Whether or not there is a recession may be immaterial to Fed policy in achieving the goal of a 2% inflation rate. The bond market may be underappreciating the risks that inflation could be more resilient now than in the recent past. The forces that contributed to what we call The Great Moderation (the period from 1980 through the Global Financial Crisis – during which inflation and interest rates fell in a secular manner through each business cycle over 40 years) have been losing their moxie. Globalization is in retreat in favor of “on-shoring” or “friend-shoring.” U.S. energy, CHIPs and infrastructure bills are domestic focused industrial policy that is likely to stimulate domestic activity. China’s reopening is likely to also be inward focused and less reliant on exports. Labor is regaining its pricing power. Unions are as popular in polls as they were 50 years ago and gaining traction while public opinion has moved further pro-worker. The tight labor market might have quite a bit to do with that. Demographics in the long-term might still have deflationary bias but presently the Millennial generation is in the prime of their family-forming lives, reminiscent of the Boomers in the 1980s.

This suggests that policy may have to remain restrictive for longer than the bond market anticipates which could mean more pressure on interest rate sensitive assets.

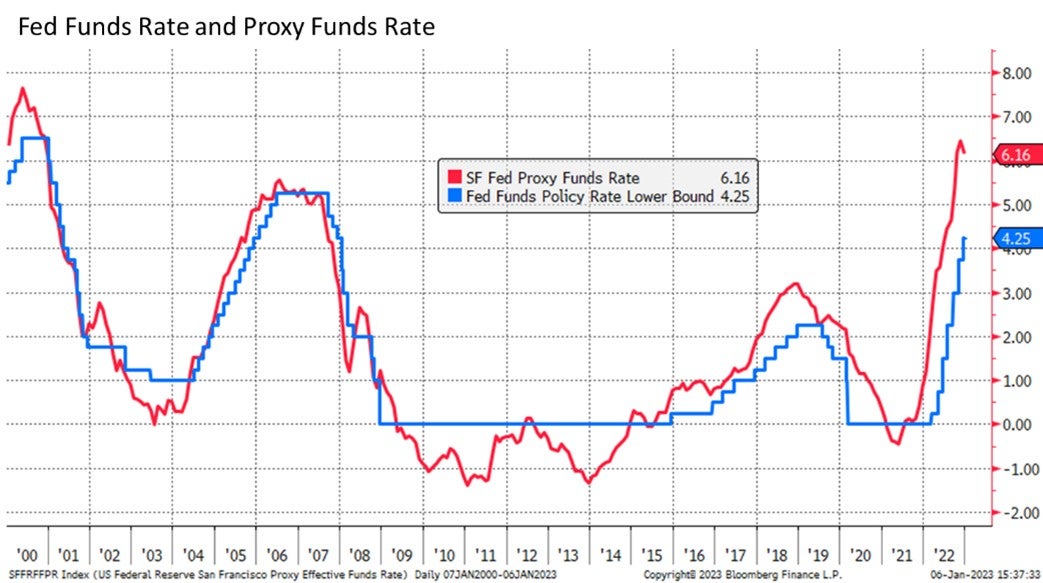

There is a counterargument claiming that officials are under-appreciating the impact of the balance sheet reduction in terms of how tight the system is. The Fed is allowing its Treasuries and Mortgage-Backed Securities holdings to roll off at a pace of $95 billion a month. Just as buying those almost $9 trillion in securities amounted to policy easing (quantitative easing (QE)), selling them or even just allowing them to mature amounts to quantitative tightening (QT). The Fed bought bonds and bid up their prices and in doing so depressed yields. The cash the banks received was then reinvested in other assets or lent out into the economy. Now the reverse is happening.

Many analysts believe that this level of monetary tightening is significantly greater than what is represented by the Fed Funds Rate. One of the data points being bandied about is the San Francisco Fed’s Proxy Funds Rate, which considers several additional factors when assessing the relative tightness of monetary policy, including the balance sheet. The proxy rate could indicate what Federal Funds Rate would typically be associated with prevailing financial market conditions if these conditions were driven solely by the funds rate.

In other words, without the other influencing factors, it is the level the Fed Funds Rate would be to create the same monetary policy conditions. Obviously influenced significantly by the level of quantitative easing or tightening, the proxy implies a tighter policy stance than before the Global Financial Crisis.

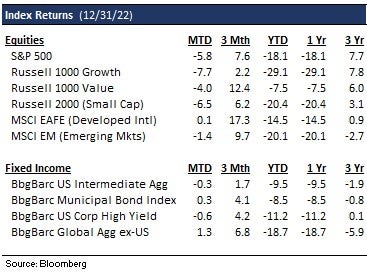

Markets Bounce After Repricing

Within most bear markets, stocks will occasionally show periods of strength, often referred to as bear market rallies. This happened late in June (up 15% from lows) and again in the fourth quarter. After a period of consolidation, stocks surged in October and November, reaching a level 12% above October lows, but ultimately they re-trenched in December when recession fears resurfaced. Despite the year-end sell-off, most asset classes finished in the black in the fourth quarter.

The S&P 500 managed to post a 7.6% return in the fourth quarter. Value stocks (12.4%) continued their leadership, and international and emerging markets outperformed the U.S. on further U.S. Dollar weakness. Bonds managed positive returns, with municipal and high yield bonds performing best domestically.

The fourth quarter rally was not enough to save the markets in 2022. The Fed’s fight against record inflation destroyed the bond market and sent stocks into bear market territory, a trend that continued into the end of the year. As a result, bonds (-9.5%) posted their worst return in history. The 18.9% decline in the S&P 500 didn’t tell the whole story as the variance in returns was significant across certain sub-asset classes. Those investments, whose performance in recent years was largely based on nearly free capital and speculation, had something of a comeuppance. Growth stocks (-29.1%) continued to struggle, while their Value counterparts outperformed (-7.5%). The late surge in foreign currencies helped international equities perform in-line with U.S. equities. High Yield bonds saw some recovery, but the most speculative sub-sectors and the related leveraged loan market sagged. But the most glaring examples of unbridled speculation coming undone happened in the crypto arena with the collapse of FTX and related fellow travelers.

More Repricing Yet to Come?

While the transition has been painful for investors, it has been necessary to re-price markets back to reasonable valuations. Valuations (P/E multiple) have declined 40%, while stock prices have only declined 20%. This kind of dislocation hasn’t been seen since the early 1970s. It is due to the meteoric rise in interest rates and the subsequent wringing of the excesses that near-zero rates brought to the market.

If history is any guide, we seem to be in the latter stages of the bear market. The average bear market lasts 13 months and drops 33% from previous peaks. The current bear market is now 12 months and counting and U.S. equities finished the year down over 20% on a price basis, and at one point, dropped over 25% (peak to trough).

While valuations would indicate that we are closer to a bottom - the reality is that we haven’t experienced a recession yet. However, a mild one seems to be the consensus. It’s hard to envision a market bottom without earnings growth turning negative first. Instead, corporate profits rose 6% in 2022. While consensus estimates for the fourth quarter are -3.0%, in our opinion, current forecasts fail to account for the challenges that companies are likely to face in the coming months. Though this doesn’t guarantee another correction, it probably lengthens the duration of the bottoming process.

The TINA (There Is No Alternative (to equities)) mantra that drove investor zeitgeist over the past few years has been replaced with a more balanced outlook now that interest rates are higher and risky assets have been given a haircut. Bonds now have reasonable yields. Exaggerated pricing for many stocks has come down. There are many more opportunities for active investing in a market where valuation matters again. Especially in a market where there are multiple opportunity sets beyond the largest ten names in the S&P 500.

We still believe that opportunities exist, even though the timing of a market bottom is unknown.

Consider adding bonds to your portfolio. Investors can now earn a 4-6% yield on relatively conservative taxable fixed income securities. A year ago, yield on conservative securities was near zero. With the Fed nearing the end of its tightening cycle, bonds are regaining their relevance in investors’ portfolios.

Look for a relative return in equities – rather than guess when the market will bottom, seek opportunities within the market. Value stocks have outperformed Growth stocks but still look attractive on a relative basis.

Look overseas – international equities have underperformed for years due to weakness in foreign currencies. As the Fed winds down and foreign central banks ramp up, foreign currencies could regain strength, which would be a huge tailwind to foreign assets. The asset class is cheap, and currency benefits could lead to outperformance even if economic growth is below trend. Emerging Markets are also cheap on multiple levels. They could benefit from a rebound in economic activity as they come out of COVID lockdown.

Consider alternative sources of return – in a world where volatility is high, consider broadening portfolios to alternative asset classes. Look for asset classes that generate income or provide a hedge to traditional are not highly correlated with equities or provide a hedge to pure equity risk.

Wealth Management does not provide accounting, legal or tax advice. This information discusses general economic and market activity and is presented for informational purposes only and should not be construed as investment advice. Views and opinions expressed herein do not account for any specific investment objective, restrictions, and/or financial circumstances of any specific client. Investors are urged to consult with their financial advisors before buying or selling any securities.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. The investment return and principal value of investment securities will fluctuate based on a variety of factors, including, but not limited to, the type of investment, amount and timing of investments, changing market conditions, currency exchange differences, stability of financial and other markets, and diversification. The statements and opinions expressed in this article herein are those of the author as of the date of the article and are subject to change. Content and/or statistical data may be obtained from public sources and/or third-party arrangements and is believed to be reliable as of the date of the article.

Products offered through Wealth Management are not FDIC Insured, are not bank guaranteed and may lose value.